Saturday, May 30, 2009

forex

Ask The quoted price at which a customer can buy a currency pair. Also referred to as the 'offer', 'ask price', or 'ask rate'.

Base Currency For foreign exchange trading, currencies are quoted in terms of a currency pair. The first currency in the pair is the base currency. For example, in a USD/JPY currency pair, the US dollar is the base currency. Also may be referred to as the primary currency.

Bid The quoted price where a customer can sell a currency pair. Also known as the 'bid price' or 'bid rate'.

Bid/Ask Spread The point difference between the bid and ask (offer) price.

Call A call option gives the option buyer the right to purchase a particular currency pair at a stated exchange rate.

Counterparty The counterparty is the person who is on the other side of an OTC trade. For retail customers, the dealer will always be the counterparty.

Cross-rate The exchange rate between two currencies where neither of the currencies are the US dollar.

Currency pair The two currencies that make up a foreign exchange rate. For example, USD/YEN is a currency pair.

Dealer A firm in the business of acting as a counterparty to foreign currency transactions.

Euro The common currency adopted by eleven European nations (i.e., Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain) on January 1, 1999.

European-style option An option contract that can be exercised only on or near its expiration date.

Expiration This is the last day on which an option may either be exercised or offset.

Forward transaction A true forward transaction is an agreement that expects actual delivery of and full payment for the currency to occur on a future date. This term may also be used to refer to transactions that the parties expect to offset at some time in the future, but these transactions are not true forward transactions and are governed by the federal Commodity Exchange Act.

Interbank market A loose network of currency transactions negotiated between financial institutions and other large companies.

Leverage The ability to control large dollar amount of a commodity with a comparatively small amount of capital. Also known as 'gearing'.

Margin See Security Deposit.

Offer See ask.

Open position Any transaction that has not been closed out by a corresponding opposite transaction.

Pip The smallest unit of trading in a foreign currency price.

Premium The price an option buyer pays for the option, not including commissions.

Put A put option gives the option buyer the right to sell a particular currency pair at a stated exchange rate.

Quote currency The second currency in a currency pair is referred to as the quote currency. For example, in a USD/JPY currency pair, the Japanese yen is the quote currency. Also referred to as the secondary currency or the counter currency.

Rollover The process of extending the settlement date on an open position by rolling it over to the next settlement date.

Retail customer Any party to a forex trade who is not an eligible contract participant as defined under the Commodity Exchange Act. This includes individuals with assets of less than $10 million and most small businesses.

Security deposit The amount of money needed to open or maintain a position. Also known as 'margin'.

Settlement The actual delivery of currencies made on the maturity date of a trade.

Spot market A market of immediate delivery of and payment for the product, in this case, currency.

Spot transaction A true spot transaction is a transaction requiring prompt delivery of and full payment for the currency. In the interbank market, spot transactions are usually settled in two business days. This term may also be used to refer to transactions that the parties expect to offset or roll over within two business days, but these transactions are not true spot transactions and are governed by the federal Commodity Exchange Act.

Spread The point or pip difference between the ask and bid price of a currency pair.

Sterling Another term for British currency, the pound.

Strike price The exchange rate at which the buyer of a call has the right to purchase a specific currency pair or at which the buyer of a put has the right to sell a specific currency pair. Also known as the 'exercise price'.

Entire nation stands by IDPs, says Zardari

In a brief address to a gathering of IDPs here at the Shah Mansoor camp, the president noted that the displaced people, who had rendered the great sacrifice of leaving their homes, needed the support of the people of Pakistan in their hour of need.

I am here to share your sufferings and problems, the president said and added the entire nation stood by them.The president, who earlier visited various sections of the camp and distributed gifts among the children and relief goods among the people, said the whole nation stood by their brethren from the areas affected by the conflict.

He directed that the best possible facilities be provided to the people and said the entire government machinery was geared up to providing all possible assistance to the affected people.He said a model camp would be set up at Jalozai and the injured and handicapped would be provided wheelchairs and other facilities.

He urged the victims to keep up their spirits and promised that the government would try to provide them better facilities they had before the operation began. He urged them to support the government and the Army in their efforts to eliminate the extremists.

Zardari said he was in a position to understand their pain as he himself was a victim of terrorism and added the day was not far when they would return to their homes. The president, accompanied by Information Minister Qamar Zaman Kaira and Interior Minister Rehman Malik, soon after his return from Karachi, went to the camp that houses refugees from the Malakand Division.

The president was received by NWFP Chief Minister Amir Haider Khan Hoti and Lt-Gen Nadeem Ahmed, Chairman of the Special Support Group, and was informed about the facilities being provided to the IDPs.

The president went around various sections of the camp and saw the food, medical and residential facilities being provided to the people. The camp houses 2,200 tents with 1,450 families, besides over 1,000 children aged 1 to 5 years.

Our correspondent adds from Islamabad: Briefing newsmen on his visit to the camp, President s spokesman Farhatullah Babar said during his visit the president announced a host of relief measures, besides setting up of five district monitoring committees, directing its members to be available to the IDPs at all times to redress their grievances and to implement the relief measures announced by the government.

The spokesman said the president was given a briefing on the relief and rehabilitation work in progress. The president also visited the medical unit and enquired about the facilities available there.

The spokesman quoted the president as saying that the government had also launched a campaign to seek international assistance in the relief and rehabilitation operation. You will not stay in these camps indefinitely and will return to your homes sooner than later and do not have to worry about your damaged properties as the government will repair and rebuild it for you, he added.

The president said the fight against militancy could not be left midway and had to be pursued to its logical conclusion because it was the fight for the survival of Pakistan. He said the government, with the consent of parliament, had adopted the policy of 3Ds Dialogue, Deterrence and Development as guiding principles in waging the war against the militancy. He said the introduction of the Nizam-e-Adl Regulation on the recommendations of parliament was an honest effort for dialogue on the part of the government.

However, he said instead of returning to peace, the militants continued on the warpath and even sought to extend their reach to other areas like Buner and publicly challenged the writ of the state. It was at this stage when it was decided to resort to the deterrence mode of the three pronged strategy, the spokesperson quoted the president as saying.

The policy of using force against the militants at this stage also had political ownership and a broad-based national support. Let there be no doubt or mistake that the government is mindful of its responsibilities and will never allow the militants to impose their obscurantist agenda on the people through the use of force, bullets and guns, the president said.

He said the government had already announced that every displaced family, whether in or out of the camps, will receive an initial grant of Rs 25,000. This grant will be paid through their accounts in the National Bank of Pakistan or any other bank designated by the State Bank.

He said the NBP and other banks designated by the State Bank will establish counters in every camp to open the accounts. Families living off camps may open account at any regular NBP branch or any other bank designated by the State Bank, he said.

He also announced free-of-cost unstitched cotton cloth for eight Shalwar Kameez suits at special outlets in camps to be established shortly for families. Tailoring facilities will also be made available at camps. Families living off the camps will also be entitled to receive similar clothing for which modalities will be announced separately, he added.

Babar said President Zardari announced that children complexes would be set up in every camp by the Bait-ul-Mal. He said a model camp had started functioning at Jalozai. President Zardari directed that the Bait-ul-Mal would arrange regular care, residence and education of children, who have lost their parents or/and do not have any guardian.

The Bait-ul-Mal will provide wheelchairs to physically disabled persons in the camps. The president said the federal government had appointed MNA Asma Alamgir as the coordinator of relief efforts for the IDPs. She will co-chair the IDP relief meetings with the NWFP chief minister on a regular basis to ensure transparency and quick and efficient delivery of relief funds and goods to the IDPs.

The minister of state for Frontier regions will move his headquarters to the NWFP until further orders to oversee the relief operations, together with the federal coordinator and the NWFP chief minister.

The chief minister will chair regular meetings attended by the coordinator, the NWFP senior minister, the secretary Safron, the chief secretary and conveners of district relief committees for review of relief efforts and prompt decisions to ensure transparency, efficiency and effective coordination.

The spokesman said the president also announced setting up of five relief committees for each district to monitor the relief efforts in their respective jurisdictions. The president directed the committees to meet every alternate day and the IDPs would have immediate access to their offices functioning round-the-clock.

Friday, May 29, 2009

Czech and Polish Central Banks Leave Rates Unchanged

After two other European central banks decided to hold their current interest rates, Czech and Polish banks chose to follow the same way and didn’t change their reference interest rates despite the fact that they both raised the rates at the end of November.

Today both central banks had their scheduled monetary policy meetings at the same time at 2 p.m. GMT. Czech National Bank left rate at 3.50%, National Bank of Poland - at 5.00%. Central banks of Sweden and Hungary held their interest rates earlier too. ECB left the rate unchanged after its last meeting on Devember 6.

The fact that four European central banks decided to follow ECB rate decision may mean only that European Union is facing a hard time both from the side of rising inflation and from the side of the slowing economic growth. Inflation matter is caused by the high oil prices that drive prices for other goods up; GDP output slowdown is attributed to the bank sector turmoil and the over-expensive euro (compared to dollar and yuan).

It is very probable now for the other European central banks (Norwegian, Danish, Slovakian, Latvian) to leave their rates unchanged. They will wait for the balance of growth/inflation to move into any direction before taking some preventive actions or continuing general monetary policy.

Poland Needs to Adopt Euro More Urgently

According to Regional Development Minister of Poland Elzbieta Bienkowska, euro should be adopted as soon as possible because zloty’s appreciation partially eliminates the value of the financial aid made by European Union and which is denominated in euro.

There is also a concern about the damage to the economic growth that may be caused by the rapidly strengthening national currency. Bienkowska urged country’s financial authorities to accelerate the euro adoption process:

Looking at the zloty exchange rate since Poland joined the EU, it seems obvious that euro adoption would be the most rational solution. It would enable us to avoid the risk created by the zloty’s strength, which may continue in the next EU budgetary period.

The Polish zloty rose 17 percent against the European currency since the country’s entry into European Union in 2004, affecting the real value of 12.8 billion euro of the financial aid received during the first two years.

Current government prefers to link zloty’s exchange rate to euro for the year or two prior to the actual adoption. Adopting euro requires also low inflation, budget deficit and public dept.

EUR/PLN declined from 3.2701 to 3.2635 in the early trading today as the zloty remained quite stable against the U.S. dollar, which is currently rising against the euro.

U.A.E., Qatar, Bahrain and Saudi Arabia Cut Rates

The United Arab Emirates decided to cut their bank repository rate by 0.25% to 5.25%; Saudi Arabia decreased its benchmark rate for deposits also by 0.25% to 4.0%; Qatar and Bahrain reduced their deposit rates by the same amount - 0.25% to 4.0%. Kuwait refrained from changing the country’s interest rate, because they’ve already removed their currency’s peg to dollar back in May 2007.

This rate change followed the cut by U.S. Federal Reserve decision to lower the rate from 4.50% to 4.25% yesterday on December 11. Gulf countries, such as Saudi Arabia and U.A.E., started to peg their national currencies to dollar decades ago, and they have to maintain the similar interest rates to keep this peg up.

Lowering the interest rates goes against the general monetary policy of the Gulf countries in the way that it stimulates inflation, which is already very high due to the devalued dollar. Fighting inflation is an important task stated by the government of U.A.E. and this rate cut can only boost up the prices growth.

Although this step contradicts anti-inflation policy, it is almost doubtless that such a small rate change won’t hurt a lot. The possibly better side effect of this change would be another reason for consideration of the dollar peg abandonment by these oil countries.

Swiss Libor Rate Unchanged at 2.75%

Swiss National Bank chose to keep the national three-month Libor (interest rate) unchanged at 2.75% after it was increased by 0.25% back in September 2007. After this announcement Swiss franc gained a little against all other major currencies except the Japanese yen.

The reason to stop increasing the interest rates further came from two sides: first, Swiss National Bank (SNB) is expecting that GDP growth will be slowed down by the global instability - the fact that wasn’t foreseen in the September economy outlook; second, inflation rate is slowing down, which removes any fundamental base for another rate hike.

With the inflation rate at the expected 0.7% rate for 2007, SNB now has nothing to worry about - over-regulating something that is working fine is not a job for central banks:

The expected downturn in economic growth will result in an improved inflation outlook for 2009 and 2010. However, rising oil prices will temporarily push up inflation in the first half of 2008. Assuming that the three-month Libor remains unchanged at 2.75%, the National Bank expects an average annual inflation rate of 0.7% in 2007, 1.7% in 2008 and 1.5% in 2009. After having passed its peak in the first half of 2008, inflation is likely to stabilise below 2%.

This rate decision wasn’t a surprise for analysts and helped CHF to gain against other currencies. Only Japanese yen, which is growing after the Nikkei Index fell down by more than 2% today, showed more power against franc, gaining almost 0.5% against Swiss currency.

British Pound Climbs as House Prices Rebound

The pound sterling rallied against the dollar and the yen after a report on house prices revealed an unexpected rise in May, boosting confidence among investors that the real estate crisis may be easing.

The excellent news for the United Kingdom currency revived hopes for this European nation, one of the most hit by the global crisis and the credit crunch. A report on consumer confidence this month showed the highest level in almost a year, reversing a trend of extremely low marks, adding to that, the house prices, which had constant and severe losses since the second semester of the past year, jumped sharply in May, against most of the expert forecasts, adding an extra stimulus for the improved attractiveness of the pound.

According to analysts, the pound has been favored this week by a combination of two distinct factors: the positive house survey and the gradual recovery in markets boosted by evidences that the global slump is easing considerably. Specialists also indicate that multiple domestic and international news brought the pound down to levels which do not reflect the real value of the currency, and as the scenario is not so gloomy for the moment, the pound is coming back to a more reasonable pricing level.

GBP/USD traded at 1.6120 from 1.5915 and GBP/JPY also rose from 154.20 to 154.73.

If you want to comment on the British pound?s recent action or have any questions regarding this currency

Wednesday, May 27, 2009

Oil prices hit six month high of $63

Crude oil price rose to a six-month high on Wednesday touching $63 per barrel on the back of a report that United States petrol supplies fell for a fifth week amidst growing optimism that the worst of the recession is over.

Photo file

Oil and Gas

This is good news for Nigeria that pegged its 2009 budget on $45 per barrel and which has been battling with declining production because of crisis in the Niger Delta.

Oil price rose to above $63 per barrel in both London and New York and Saudi Arabia’s oil minister, Ali al-Naimi, was quoted as saying, oil demand had started to recover.

Crude price rose above its 200-day moving average for the first time since September, a sign that prices may rally further.

Crude oil for July delivery rose as much as $1, or 1.6 per cent, to $63.45 a barrel in electronic trading on the New York Mercantile Exchange. That’s the highest since November 13, 2008. Oil reached $63.12 at mid-morning trading in London

“It looks like we won’t see any significant deterioration in demand anymore, hence Organisation of Petroleum Exporting Countries is bullish,” said Andrey Kryuchenkov, an analyst at VTB Capital in London. “But, we still need to see improving gasoline demand in the US.”

The US Conference Board’s sentiment index surged to 54.9, more than forecast and the biggest increase since 2003, the New York-based research group said yesterday.

OPEC, responsible for 40 per cent of global crude supply, is likely to keep output quotas unchanged for a second time this year as recovering oil prices forestall the need for new cuts, according to a Bloomberg survey published on May 22.

The OPEC has “no need” to cut oil production because there are signs of a recovery in demand, Saudi Arabia’s Ali al-Naimi told reporters on Thursday in Vienna, where the group meets today.

Yen Weakens as Japanese Investors Purchase More Overseas Assets

May 28 (Bloomberg) -- The yen fell toward a two-week low against the euro and weakened versus the dollar on speculation Japanese investors will buy more overseas assets on signs the global recession is easing.

The yen weakened versus all 16 of the most-traded currencies after Japan’s Ministry of Finance said the nation’s investors boosted purchases of foreign bonds to the most in a month. Australia’s dollar rose toward a seven-month high against the U.S. currency on optimism the world economy is recovering, reviving demand for higher-yielding securities. New Zealand’s dollar gained after Standard & Poor’s raised its outlook on the country’s debt rating.

“Signs that the worldwide slump is waning are making Japanese investors more comfortable in putting money into higher-yielding assets,” said Tsutomu Soma, a bond and foreign- exchange dealer at Okasan Securities Co. in Tokyo. “S&P’s upgrade of New Zealand’s credit-rating outlook is likely to whet their appetite.”

The yen declined to 133.26 per euro as of 6:43 a.m. in London from 131.83 in New York yesterday, after falling to 133.53, the lowest since May 12. The yen dropped to 96.33 per dollar from 95.34, after reaching 96.58, the weakest since May 19. The dollar traded at $1.3835 per euro from $1.3825.

Australia’s currency gained 0.3 percent to 77.81 U.S. cents and advanced 1.4 percent to 74.97 yen. New Zealand’s dollar strengthened 0.7 percent to 61.87 U.S. cents and rose 1.8 percent to 59.62 yen.

Best Performer

New Zealand’s dollar is the best performer against the yen this month, gaining 7.1 percent. The nation’s 10-year government bonds offer 4.41 percentage points more yield than similar- maturity Japanese debt.

The so-called kiwi reversed earlier declines versus the greenback after S&P raised the outlook on the country’s sovereign debt rating to stable from negative, saying today’s budget showed the “government in sound position.”

The yen also fell the most in a week against the euro as the Nikkei 225 Stock Average reversed earlier losses to gain 0.3 percent, boosting the appetite for risk.

“Equity markets of emerging economies, including Asia, are holding a relatively firm undertone, which means risk appetite is still reasonably strong,” said Akira Takeuchi, a Tokyo-based currency dealer at Chuo Mitsui Trust & Banking Co., a unit of Japan’s seventh-largest banking group. “The yen will be sold against higher-yielding currencies.”

Japanese investors bought 641.1 billion yen ($6.6 billion) more overseas bonds and notes than they sold in the week ended May 23, the biggest net purchases in a month, according to a report released by the Ministry of Finance today.

Investment Trusts

Nomura Asset Management Co., a unit of Japan’s largest brokerage firm, reopened its higher-yielding bond fund to new investments yesterday. The net assets of the fund, which includes holdings such as Brazilian real-denominated debt, rose to 287.9 billion yen from 45.3 billion yen in January, according to Nomura’s Web site.

Benchmark interest rates are 3 percent in Australia and 2.5 percent in New Zealand, compared with 0.1 percent in Japan and as low as zero in the U.S., attracting investors to the South Pacific nations’ higher-yielding assets. The risk in such trades is that currency market moves will erase profits.

Japanese retail sales fell for an eighth month in April, reducing the appeal of the nation’s currency. Sales slid 2.9 percent from a year earlier after dropping a revised 3.8 percent in March, the Trade Ministry said in Tokyo.

Demand for the relative safety of the yen and the dollar may increase after the Federal Deposit Insurance Corp. said yesterday the number of “problem” banks grew to a 15-year high, reviving concern about the health of the U.S. banking system.

‘Problem’ Banks

The FDIC classified 305 banks as “problem” and the total assets involved rose 38 percent to $220 billion, the highest since 1993, the agency said, without identifying any of the lenders. The FDIC said its insurance fund slumped 25 percent to the lowest level in 15 years.

The dollar also traded near a one-week high against the euro on speculation General Motors Corp. may file for bankruptcy this week, renewing demand for the relative safety of the greenback.

A General Motors bankruptcy filing became almost certain after the world’s largest automaker failed yesterday to persuade enough bondholders to take equity in a streamlined company in exchange for $27 billion of debt. The debt-for-equity swap offer by GM failed to win the required 90 percent approval of bondholders by the time it expired last night.

‘Inevitable’

“GM’s insolvency looks practically inevitable, which would likely cause risk aversion,” said Masanobu Ishikawa, general manager of foreign exchange at Tokyo Forex & Ueda Harlow Ltd., Japan’s largest currency broker. “This could spark buying of the dollar.”

Demand for the euro may weaken before a government report that economists say will show German unemployment rose for a seventh month as company orders slumped in the worst recession in half a century.

The jobless rate increased a seasonally adjusted 64,000 in May, sending the adjusted jobless level to 8.4 percent from 8.3 percent, according to a Bloomberg News survey of economists before the Federal Labor Agency report today.

“Given renewed concerns about the banking system and the economy there following the rapid run-up of late, the euro may be sold back toward $1.37,” said Ryohei Muramatsu, manager of Group Treasury Asia in Tokyo at Commerzbank AG, Germany’s second-largest bank.

Gold edges down on dollar, ETF unchanged

Market participants said gold was moving inversely to the U.S. dollar, and that any bounce in the currency was likely to weigh on the precious metal, as investors view gold as a currency hedge.

"(Gold's direction at the moment) really depends on how the dollar pans out, especially after the bout of selling on concerns that the U.S. credit rating may be affected by the large amount of debt the U.S. has," said Adrian Koh an analyst at Phillip Futures.

Moody's Investors Service affirmed its top credit rating for the United States on Wednesday, but warned that if the U.S. failed to reduce current debt levels once economic growth returns, the credit grade could eventually come under pressure.

Gold was at $946.85 per ounce at 11:06 p.m. EDT, down 0.1 percent from New York's notional close of $948.10.

U.S. gold futures for June delivery were at $946.70, down 0.7 percent from settlement on the COMEX division of the New York Mercantile Exchange.

The dollar held steady against the euro on Thursday, having pulled up from five-month lows hit against the single European currency last week due to short-covering.

The dollar rose 0.4 percent against the yen to 95.69 yen.

A spike in U.S. Treasury yields triggered a selloff in equity markets on Wednesday, as investors feared rising funding costs might delay a potential recovery in the world's largest economy.

Phillip Futures' Koh said he believed gold had the potential to move higher from a technical point of view.

"I am still positive on gold should we head higher and break above the previous highs of $960," he said.

"However, for that to happen, the $940 support will have to hold and if it doesn't, then we may see a continuation of the retracement in gold prices," he said.

The world's largest gold-backed exchange-traded fund, the SPDR Gold Trust, said its holdings stood at 1,118.76 metric tons as of May 27, unchanged from the previous day.

Gold markets appear to have largely factored in news that General Motors Corp (GM.N) appears close to a bankruptcy filing, which would be the largest ever for a U.S. industrial company.

On Wednesday, GM said a bond exchange offer had failed to win support from investors holding $27 billion of its debt.

However, the report has weighed on platinum and palladium, which are affected by news from the auto industry due to their heavy use as autocatalysts, needed to clean exhaust fumes.

Precious metals prices at 11:03 p.m. EDT

Metal Last Change Pct chg YTD pct chg Turnover

Spot Gold 946.90 -1.20 -0.13 7.58

Spot Silver 14.64 -0.08 -0.54 29.33

Spot Platinum 1126.00 -5.50 -0.49 20.82

Spot Palladium 222.00 0.00 +0.00 20.33

TOCOM Gold 2932.00 17.00 +0.58 13.95 19463

TOCOM Platinum 3507.00 16.00 +0.46 32.24 5995

TOCOM Silver 449.00 7.70 +1.74 40.62 172

TOCOM Palladium 700.00 -11.00 -1.55 27.27 171

Euro/Dollar 1.3838

Dollar/Yen 95.91

TOCOM prices in yen per gram, except TOCOM silver which is priced in yen per 10 grams. Spot prices in $ per ounce.

Monday, May 25, 2009

Euro Continues to Rise, but Technical Obstacles Exist

Over the last couple months, the Euro has thoroughly outperformed the Dollar, which recently fell to a five-month low on a trade-weighted basis. Over the same period, global stock and commodity prices have also risen quickly, which is not a coincidence. In other words, investors are allocating capital on the basis of risk, rather than in accordance with (economic) fundamentals. For example, “ICE’s Dollar Index and crude oil have a correlation of minus 0.61 in the past two months, compared with minus 0.26 since the start of the year,” as rising oil prices and the declining Dollar feed back into each other.

In other words, investors are allocating capital on the basis of risk, rather than in accordance with (economic) fundamentals. For example, “ICE’s Dollar Index and crude oil have a correlation of minus 0.61 in the past two months, compared with minus 0.26 since the start of the year,” as rising oil prices and the declining Dollar feed back into each other.

Meanwhile, “Implied volatility on major currencies, which reflects investors’ expectations of currency swings, fell to 13.96 percent yesterday, from…17.22 percent at the end of March. A drop in volatility tends to signal less demand for options to protect investors from currency swings.” This indicator is now at its lowest level since the days preceding the Lehman Brothers bankruptcy and subsequent stock market collapse. One would normally expect a correlation between risk and return, but in this case, rising returns have been accompanied by lower risk.

Even more unbelievable is that this decline in risk is taking place against the backdrop of declining economic fundamentals. “Risk appetite in the currency market is nothing short of impressive considering the fact that the Fed reduced their growth forecasts,” said one analyst. However, “The euro-area economy will contract 4.2 percent this year, according to the International Monetary Fund, more than the projected 2.8 percent contraction in the U.S. and 4.1 percent slump in the U.K.” If investors were focusing on this divergence in economic growth, one would expect the Euro would be falling.

One hypothesis is that inflation-conscious traders are flocking to the Euro, since the ECB remains vigilant about fighting inflation, even in the face of declining prices and aggregate demand. After cutting rates to a record low 1% earlier this month, the ECB unveiled its own version of a quantitative easing plan, involving the purchase of 60 billion euros worth of low risk securities. But this is a pittance, both relative to the size of the EU economy (it represents a mere .6% of GDP) and compared to the Trillion Dollar Fed program. This led one analyst to call the ECB’s plan “chicken feed.” While all of this is noteworthy, it’s unlikely that this is having a meaningful effect on forex markets, which still remain focused on (avoiding) deflation.

If the Euro is to continue rising, it must overcome some technical obstacles. “The euro could hit a ceiling if the recent resilience of U.S. stock markets faces headwinds. ‘At some point…stronger nongovernment growth has to show up to sustain and justify these moves in equities.’ ” It’s interesting that the fear of Euro bulls is not that the EU economy won’t recover, but rather that US stock prices are overvalued. Given recent market movements, however, their concerns are reasonable, and “any disappointment [in corporate fundamentals] could provide an excuse to take profit [this] week — benefiting the dollar.”

Asian Currencies Rally for Third Straight Month

According to a recent Reuters poll, investors are increasingly bullish on emerging market Asian currencies, including the Taiwan dollar, Indonesian rupiah, Singapore dollar, Malaysian ringgit, Philippine peso, South Korean won, and Indian rupee. The Thai Baht wasn’t covered by the poll, but given its strong performance over the last few months, it seems safe to include it in the bunch.

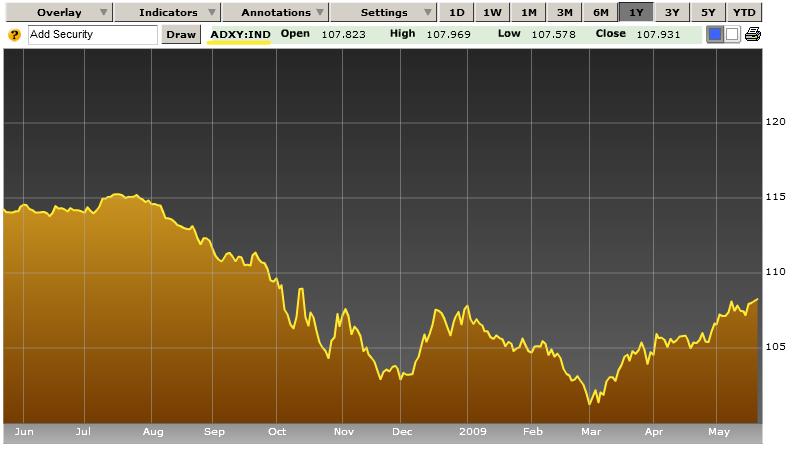

This uptick in sentiment is somewhat unspectacular, since “The Bloomberg-JPMorgan Asia Dollar Index, which tracks the 10 most-active regional currencies,” has now risen for almost three consecutive months [See chart below]. Leading the pack are the Taiwan Dollar and South Korean Won, which recently touched five-month and seven-month highs, respectively. “The Korean currency has climbed 28 percent since reaching an 11-year low of 1,597.45 in March.”

Investors are now pouring money back into Asia at rapid clip. “Asia ex-Japan received $933 million in the week ended May 20, the most among emerging-market stock funds, bringing the total this year to $6.9 billion.” Meanwhile, the “The MSCI Asia Pacific Index of regional stocks climbed 22 percent this quarter” while Chinese stocks are up 45% since the beginning of 2009.

But it’s unclear - doubtful is a better word - whether this rally is supported by economic fundamentals. One commentator summarized this contradiction as follows: “Improved sentiment has led to a massive resurgence in flows to emerging markets, irrespective of the underlying data, which remains weak. Investors are going out of dollars to riskier markets, riskier currencies.”

Let’s drill down into some of the data. Chinese exports fell 15% in April. Japan’s economy contracted 15% in the most recent quarter. Singapore’s exports are down 20% on an annualized basis. The South Korean economy is projected to shrink by 2% this year. The Central Bank of Thailand just cut its benchmark interest rate to an unbelievable 1%. The only bright spot economically is Taiwan, which is benefiting both from improved economic ties with China and a healthy current account surplus. I suppose everything is relative, as “developing Asian economies will grow 4.8 percent in 2009, even as the world economy contracts 1.3 percent” according to the International Monetary Fund.

The notion that the rally is not rooted in fundamentals is shared by the region’s Central Banks, which clearly realize that economic recovery will be much more difficult in the face of currency appreciation. One analyst argues that, “Until the signs of global economic recovery become more convincing, central banks will unlikely tolerate significant currency appreciation.” The Central Banks of South Korea, Taiwan, and Indonesia have already actively intervened to hold their currencies down, while Malaysia and Singapore (discussed in a Forexblog post last week) have also intervened for the sake of stability.

As a result, this rally could soon begin to lose steam. “A ‘correction’ in regional currencies is ‘appropriate’ following recent gains,” said one analyst. Another has called the rally “overdone.” Still, Central Banks and economic data pale in comparison to capital flows and risk/reward analysis. In short, these currencies (and other investments) will continue to find buyers for as long as there are those hungry for risk. Citigroup, whose “Asia-Pacific foreign-exchange volume may rise about 10 percent from the first quarter,” is bullish. A representative of the firm declared: “Fund managers are still ’sitting on lots and lots of cash’ so the pickup in volumes will continue.”

US Trade Deficit Nears 10 Year Low; Good News for USD?

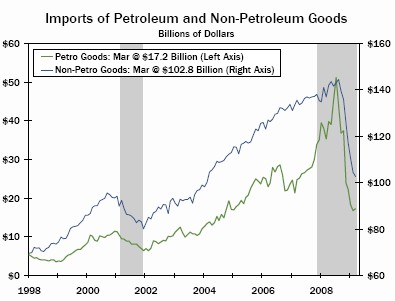

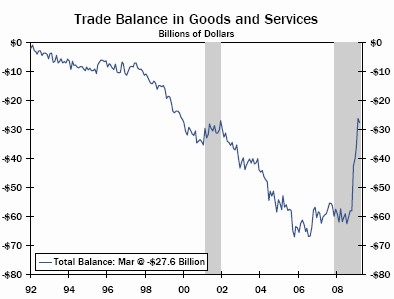

Over the last year, declines in imports and commodity prices have contributed to a veritable collapse in the US trade imbalance. While the deficit increased to $27 Billion last month, the general trend is definitely still downwards.

Since the inception of the credit crisis, US imports have fallen by a record 40%, on an annualized basis. In March, “Imports decreased 1 percent to $151.2 billion, the fewest since September 2004. Demand fell for industrial supplies such as natural gas and steel and for capital goods such as engines and machinery, reflecting the slump in U.S. business investment.” Lower commodity prices have also played a role on the imports side of the equation. In fact, if not for a slight uptick in energy prices, the deficit probably would have declined further this month.

Exports are also falling, but at a slower pace, such than the net effect is a more positive US balance of trade. “The 2.4% monthly fall in exports in March more than reversed the 1.5% rise the month before. But even that 2.4% drop compares well with the monthly declines of 6% plus that had become the norm since last September,” explains one economist. In other words, worldwide demand (as symbolized by US exports), is stabilizing.

Economists remain divided as to whether the trade deficit will continue to decline: “The low-hanging fruit has been achieved, and it will be difficult to narrow the trade deficit by much more going forward, especially if the vicious downturn in the economy seen in the fourth quarter and first quarter has begun to abate…..Once the economy begins to return to health in earnest (mainly a 2010 story), the trade deficit will likely begin to re-widen.” But a competing view expects “drooping consumer demand to weigh on imports and keep the trade deficit on a narrowing trend in the coming months,” in which case the deficit could fall to $350 Billion by the end of the year. Compared this to the record $788 Billion deficit of 2006!

While the balance of trade doesn’t figure directly into GDP (although it confusingly is incorporated into the expenditure method), a declining trade balance is generally reflective of a healthier economy. It implies that either exports are growing relatively faster than imports, and/or consumers are diverting more of their relative spending towards domestic consumption, both of which should contribute positively to GDP. Summarizes one economist, “If the current account did move towards balance, then it would allow the U. S. economy to probably grow at a more sustainable rate in the long term.”

The idea of sustainability (not in the environmental sense, unfortunately) is also connected to the US Dollar. Generally speaking, it is the Dollar’s role as the world’s reserve currency which has enabled the US to run a trade imbalance almost continuously for the last 30 years. In other words, trade surplus economies are willing to accept Dollars because they can be stably and profitably invested in the US. In this regard, one commentator hit the nail right on the head: “When it comes to the U.S. trade gap, how many refrigerators the U.S. sells overseas is far less important than how many dollars the rest of the world wants.”

ts.”

Sunday, May 24, 2009

Market Brief

| The trend of dollar weakness continues to dominate FX markets, with the Jpy being the only currency to decline against it. The EurUSd surged 125pips breaking a major resistance point of 1.40, while the UsdJpy trades sideways hovering near the previous session’s close. The GbpUsd rose 66pips establishing a new target of 1.5950, despite yesterday’s concern regarding a possible downgrade of UK sovereign credit. Equity markets are positive in the US and Europe, with the Dow and FTSE both higher by less than 1.00%. Bond yields continued to climb following strong selling pressure in the 10 and 30yr points of the curve and speculation that the US sovereign credit may be subject to some level of scrutiny following the UK’s situation. Commodities are mixed with oil trading at $61bbl, and gold prices higher at $957oz, both moves were minimal on a percentage basis. In the UK, GDP data came out in line with expectations with growth contracting 4.1% on an annual basis and 1.9% (QoQ). Both exports and imports declined illustrating the severity of the downturn in the UK economy, both data points were at or better than expected not having a substantial effect on the cable. The GbpUsd is likely to breakout higher if the 1.5972 resistance level can be broken, otherwise we see support at 1.5785 in the near-term. There were no economic data releases out of the US or Europe, some speculators are anticipating that the Euro will reach a target of 1.47, an estimate which may be a bit aggressive from our perspective. From a technical perspective, the current price of the Euro retraced 50% back to its all time high of 1.6038. This is a signal we are at a crossroads where support and resistance points will be increasingly significant to determine ranges. Risk Disclaimer: Although every investment involves some degree of risk, the risk of loss in trading off‐exchange forex contracts can be substantial. Therefore if you are considering trading in this market, you should be aware of the risks associated with this product so you can make an informed decision prior to investing. The material presented here is not to be construed as trading advice or strategy. ACMNY makes a strong effort to use reliable, expansive information, but we make no representation that it is accurate or complete. In addition, we have no obligation to notify you when opinions or data in this material change. |

Forex News and Events

US Dollar Plunges Into Oversold Levels, Signals Potential for Reversal

Fundamental Outlook for US Dollar: Neutral

- US homebuilder confidence rose to the highest levels since September, according to the NAHB

- On the other hand, US housing starts and building permits plummeted to new record lows

- The Federal Reserve’s outlook for growth and unemployment has deteriorated, according to the latest FOMC minutes

The US dollar was easily the weakest of the majors last week, which was interesting in light of the fact that US equities and the CBOE’s VIX volatility index ended virtually unchanged, albeit with some rocky price action in between. Indeed, if there were any signs that US assets were losing their status of “safe havens,” it was this: After Standard & Poor’s downgraded the outlook for the UK from “stable” to “negative” due to their “deteriorating public finances,” ballooning national debt in the US spurred speculation that the same could happen to their economic outlook, if not their long-term credit rating altogether. In fact, the US dollar decline was in lockstep with a plunge in Treasury prices, highlighting a drop in demand for all things dollar-related. However, given the extent of the greenback’s decline, this coming week should be very interesting. Will the US dollar go back to trading in line with risk trends, gaining with other low-yielding currencies, or will it trade as the one of the “riskiest” assets out there? Since the DXY index is well into oversold levels, technical factors suggest that the dollar could bottom in the near-term. As they say though, “the trend is your friend,” so traders should be cautious.

This week’s US economic calendar is chocked full of releases. On Tuesday, the Conference Board’s consumer confidence index for the month of May is forecasted to continue rising from its record low of 25.3 reached in February up to 43.0. With record keeping having begun in 1967, the steady plunge in sentiment from the 2007 highs of 111.90 makes the extent of the recession especially clear.

On Wednesday, the National Association of Realtors (NAR) is anticipated to report that existing home sales rose 2.0 percent in April to an annual pace of 4.66 million from 4.57 million. However, there are indications that the results could prove to be disappointing as the Commerce Department reported on May 19 that housing starts plunged by 12.8 percent during the month of April, and a whopping 54.2 percent from a year earlier, to a record low annual pace of 458,000.

On Thursday, the release of US durable goods orders are projected to show that domestic demand may have increased slightly at the start of Q2, as they are forecasted to have risen 0.5 percent in April, but excluding transportation the index is anticipated to fall 0.3 percent. While the headline result will have the most impact on forex trading, the markets should keep an eye on non-defense capital goods orders excluding aircraft, as this number serves as a leading indicator for business investment. The three-month annualized figures remain deeply negative, but the monthly component has improved over the past two months and a continuation of this dynamic would be supportive of outlooks for a slow recovery in the US economy.

Finally, on Friday, the second round of US Q1 GDP estimates are due to hit the wires, and the results could be market-moving. The preliminary reading is forecasted to be revised up to -5.5 percent from -6.1 percent, which also marks an improvement when compared to the Q4 2008 result of -6.3 percent. There is some evidence that revisions will be to the downside, though. First, the US trade deficit widened for the first time in eight months during March by 5.5 percent to $27.6 billion. A breakdown of the report showed that exports slumped 2.4 percent to a more than two-year low of $123.62 billion while imports fell 1.0 percent to $151.196 billion. According to Bloomberg News, the Commerce Department used a much larger increase in exports when calculating Q1 GDP, suggesting that initial estimates of a 6.1 percent annual contraction may have been optimistic. Also, personal consumption is forecasted to be adjusted to 2.0 percent from 2.2 percent after March advance retail sales were revised down to -1.3 percent from -1.1 percent.

Forex Trading Weekly Forecast - 05.25.09

Fundamental Outlook for US Dollar: Neutral

- US homebuilder confidence rose to the highest levels since September, according to the NAHB

- On the other hand, US housing starts and building permits plummeted to new record lows

- The Federal Reserve’s outlook for growth and unemployment has deteriorated, according to the latest FOMC minutes

The US dollar was easily the weakest of the majors last week, which was interesting in light of the fact that US equities and the CBOE’s VIX volatility index ended virtually unchanged, albeit with some rocky price action in between. Indeed, if there were any signs that US assets were losing their status of “safe havens,” it was this: After Standard & Poor’s downgraded the outlook for the UK from “stable” to “negative” due to their “deteriorating public finances,” ballooning national debt in the US spurred speculation that the same could happen to their economic outlook, if not their long-term credit rating altogether. In fact, the US dollar decline was in lockstep with a plunge in Treasury prices, highlighting a drop in demand for all things dollar-related. However, given the extent of the greenback’s decline, this coming week should be very interesting. Will the US dollar go back to trading in line with risk trends, gaining with other low-yielding currencies, or will it trade as the one of the “riskiest” assets out there? Since the DXY index is well into oversold levels, technical factors suggest that the dollar could bottom in the near-term. As they say though, “the trend is your friend,” so traders should be cautious.

This week’s US economic calendar is chocked full of releases. On Tuesday, the Conference Board’s consumer confidence index for the month of May is forecasted to continue rising from its record low of 25.3 reached in February up to 43.0. With record keeping having begun in 1967, the steady plunge in sentiment from the 2007 highs of 111.90 makes the extent of the recession especially clear.

On Wednesday, the National Association of Realtors (NAR) is anticipated to report that existing home sales rose 2.0 percent in April to an annual pace of 4.66 million from 4.57 million. However, there are indications that the results could prove to be disappointing as the Commerce Department reported on May 19 that housing starts plunged by 12.8 percent during the month of April, and a whopping 54.2 percent from a year earlier, to a record low annual pace of 458,000.

On Thursday, the release of US durable goods orders are projected to show that domestic demand may have increased slightly at the start of Q2, as they are forecasted to have risen 0.5 percent in April, but excluding transportation the index is anticipated to fall 0.3 percent. While the headline result will have the most impact on forex trading, the markets should keep an eye on non-defense capital goods orders excluding aircraft, as this number serves as a leading indicator for business investment. The three-month annualized figures remain deeply negative, but the monthly component has improved over the past two months and a continuation of this dynamic would be supportive of outlooks for a slow recovery in the US economy.

Finally, on Friday, the second round of US Q1 GDP estimates are due to hit the wires, and the results could be market-moving. The preliminary reading is forecasted to be revised up to -5.5 percent from -6.1 percent, which also marks an improvement when compared to the Q4 2008 result of -6.3 percent. There is some evidence that revisions will be to the downside, though. First, the US trade deficit widened for the first time in eight months during March by 5.5 percent to $27.6 billion. A breakdown of the report showed that exports slumped 2.4 percent to a more than two-year low of $123.62 billion while imports fell 1.0 percent to $151.196 billion. According to Bloomberg News, the Commerce Department used a much larger increase in exports when calculating Q1 GDP, suggesting that initial estimates of a 6.1 percent annual contraction may have been optimistic. Also, personal consumption is forecasted to be adjusted to 2.0 percent from 2.2 percent after March advance retail sales were revised down to -1.3 percent from -1.1 percent.

Friday, May 22, 2009

Ruble Strengthens to New 2-Month High

Ruble Strengthens to New 2-Month High

The Russian ruble rose to its new maximum since January 14 against the U.S. dollar today as the current oil prices still suggest that the December-January devaluation was too strong.

The Russian ruble rose to its new maximum since January 14 against the U.S. dollar today as the current oil prices still suggest that the December-January devaluation was too strong.

The ruble also gained against the euro and reached a new high since January 26 against it. The Russian ruble is pegged to the basket of currencies that consists of 55 percent U.S. dollars and 45 percent euros. The oil now trades above $60, which, if not compared to the overpriced $150 per barrel seen in mid 2008, is a high price that should definitely support Russia’s currency.

Currently the Bank of Russia is committed to buy out excess of dollars and euros out of the domestic currency market to hold the ruble at above 36.95 against the basket of currencies. That should stop the ruble from appreciating any farther. On the other hand the government may use the appropriate moment to strengthen the currency before the possible high inflation wave in autumn to have some extra tool against the growing prices at that time.

USD/RUR went down from 31.843 to 31.697 as of 8:32 GMT today. EUR/RUR declined from 43.292 to 43.239.

If you want to comment on the Russian ruble’s recent action or have any questions regarding this currencyNZD Gains for 4th Day Against U.S. Dollar

The New Zealand dollar rose for the fourth straight day against its U.S. counterpart and advanced for the second day versus the Australian dollar today, assisted by the signs of the global recession’s easing.

The New Zealand dollar rose for the fourth straight day against its U.S. counterpart and advanced for the second day versus the Australian dollar today, assisted by the signs of the global recession’s easing. The Australian dollar also continued to rise against the greenback and the yen as the commodity prices rose considerably this week. The Asian region demonstrates a less significant drop in economy than the market strategists first believed and that helps the developed economies of Australia and New Zealand with the inflow of funds. The immigration to the New Zealand also rose to the new 5-year high level.

Both gold and silver demonstrated a serious uptrend during the last three days and now the «Aussie» is already trading above its important resistance level against the U.S. dollar, while the «kiwi» slowly approaches such resistance levels. Analyst say that if you are bullish on the commodities you have to be bullish on both AUD and NZD.

NZD/USD rose from 0.6039 to 0.6074 as of 8:06 GMT today. NZD/JPY climbed up from 57.24 to 57.47. AUD/USD rose from 0.7734 to 0.7746, while AUD/JPY remained virtually unchanged near 73.30 level. AUD/NZD declined for a second day today — from 1.2788 to 1.2746.

If you want to comment on the New Zealand dollar’s recent action or have any questions regarding this currency,Dollar Down to January Levels on Credit Rating Concerns

The dollar fell to the lowest level against the euro since early January as the S&P credit rating agency revised U.K. rating outlook and traders are afraid that the U.S. will be next.

The dollar fell to the lowest level against the euro since early January as the S&P credit rating agency revised U.K. rating outlook and traders are afraid that the U.S. will be next.

The euro rose against both the U.S. dollar and the British pound today as the possible credit rating downgrade is one of the worst events for the debt-relying economies and currencies of both the United States and the United Kingdom. The Japanese yen also rose against the dollar and the pound, additionally spurred by the commentary by Japan?s Finance Minister Kaoru Yosano that the government won’t use the currency intervention to keep the yen down.

Standard & Poor’s changed the U. K. AAA credit rating outlook from «stable» to «negative» yesterday. Although some analysts believe that it will take some time and probably a real downgrade of the U.K. rating itself before the U.S. rating outlook will be changed to «negative», the dollar bulls are close enough to a panic. A downgrade of a rating means less attractive government bonds, which means less attractive currency and a high probability that the central bank will have to print the needed money.

EUR/USD rose from 1.3900 to 1.3930 as of 8:52 GMT today after reaching as high as 1.3977 earlier — the highest level since January 2. GBP/USD fell from 1.5850 to 1.5763. EUR/GBP went up from 0.8768 to 0.8830, while USD/JPY fell from 94.34 to 94.15.

If you want to comment on the U.S. dollar’s recent action or have any questions regarding this currency,Thursday, May 21, 2009

New York Fed to Discontinue Publication of Foreign Exchange Rates

Wednesday, May 20, 2009

About AceTrader

| As the Internet operation arm of Trendsetter Financial Markets Limited, AceTrader provides 24-hour realtime forex trading recommendations and market commentaries to online traders through our website. These trading recommendations and market commentaries were originally available to institutional traders through Reuters network only. Now it's available to all individual online traders. |  |

We provide genuine real-time forex market commentaries and trading recommendations to both Reuters and Internet users. Led by world renowned technical analyst, Wilson Leung, we have a team of 7 analysts monitoring the market and updating our recommendations and commentaries 24 hours a day. Wilson Leung has over 20 years of experience in forex market. He is a regular speaker at Technical Analysis seminars all over the world and has conducted over 100 such seminars with Reuters for forex traders in Asia, Continental and Eastern Europe, Scandinavia, CIS and the Middle East.

Our key strengths are:

- Precise Recommendations

No-nonsense clear-cut recommendations that include specific entry, stop, target levels. - Full coverage of the market

As long as the market is open, we're there providing insights to you. - Real-time updates

Foreign exchange is a fast market, with real-time being the vital ingredient for success; analysis from an hour ago can sometimes become useless. - Multi time-frame recommendations

To profit from the market, one needs to know the short term, medium term and long term trend. Providing intra-day, daily, weekly and medium term analysis and recommendations is our unique feature.

|  |

Forexnews.com

Intellectual Frontier Group Inc. (I.F) was created in 2005 with the goal of catering to the needs of the individual investor with risk capital to seek out excess returns in traditional and non-traditional investments. I.F was incorporated in the British Virgin Islands and comprise of a unique team of seasoned Wall Street professionals with over 100 years of combined experience in trading, banking and other investment disciplines. |  | ||

| I.F will capitalize on an array of strategies to seek out opportunities in the financial markets and business opportunities to maximize investors' returns. Our team of experienced financial professionals manages risk effectively to produce consistent and attractive returns relative to the market. We are dedicated to identifying innovative opportunities to help create value and reach the investment goals of our clients. Our investment philosophy employs objective and systematic methods to maximize returns while simultaneously reducing risk. By leveraging the experience and knowledge of our team, we continually optimize our portfolio strategies with new ideas. | |||

Tuesday, May 19, 2009

Taiwan Dollar Rose on Bail-Out Expectations

The Taiwanese dollar gained today after four days of declining against the U.S. dollar as the speculations that the U.S. senate will approve the $700 billion bail-out plan by the end of this week spurred confidence in the Asian currencies.

The Taiwan’s currency rose from the 8-month bottom versus its American counterpart with the whole third quarter of 2008 being the worst for TWD since the Asian crisis of 1997. Taiwan’s central bank intervened with about $600 million of USD yesterday to support the local currency on the Forex market.

The early fears of the investors, that the U. S. Congress won’t pass the Paulson’s $700 billion plan to buy out troubled assets, created a lot of risk aversion, which in its turn pushed Asian currencies to the bottom. Now the panic is cooling down and the traders expect that the plan will be accepted soon.

USD/TWD dropped from 32.130 to 32.045 as of 8:06 GMT today after closing at 32.275 during yesterday’s trading session.

Russian Ruble Rises as Oil Hits Six-Month High

The Russian currency and stock market posted a week of gains as the price of oil rose, pushed by rising demand in Asia, the MICEX Index is at its highest level since October.

The MICEX Index, a reference in the Russian stock market compromising 30 of the most relevant stocks, rose above 1,000 for the first time since October, and also pushed by rise of the crude oil in New York, the Russian ruble posted sharp gains, to the point the central bank bought foreign currency to avoid the national currency to rally further. The Russian ruble had severe losses last year, being a major energy supplier of oil and gas for Europe, as the price of commodities went down, the national currency also lost space in international markets.

Economists are expecting months of improvements for the Russian economy, even if its currently facing a complicated scenario, with virtually no credit options, a rise in the price of oil could revive the Russian markets, which consequently would flow money to all sectors of the economy. At the same time that optimism is entering Russia, the world demand for stocks is still very unstable, which brings uncertainty for the Russian financial future.

The USD/RUB currency pair virtually has not changed being traded at 32.5055 from a previous price of 32.5660.

If you want to comment on the Russian ruble’s recent action or have any questions regarding this currency, please,Monday, May 18, 2009

JPY - The Yen Declines vs. the USD as Stocks Rebound

The JPY declined by over 1% against the EUR to 130.92 from 129.42 yesterday .The Yen also weakened earlier 1% against the Dollar to 95.99, because of selling to protect options that would become worthless should Japan's currency rise further, according to analysts.

The Yen may reverse this year's decline against the Dollar as Japan's currency succeeds the greenback as the best refuge from the financial crisis. The Japanese currency may appreciate to 92 yen by the end of the year as the link between the greenback and risk aversion deteriorates. As for today, forex traders are advised to follow the U.S. Core CPI data release at 12.30 GMT, as the results of this are highly likely to determine USD/JPY trading going into next week.

EUR - The Euro-Zone Goes Defensive on ECB Policy Concerns

The EUR held on to gains made on Thursday against the greenback keeping within sight of recent highs made as optimism has grown that the worst of the global economic crisis may be over. The European currency, which hit a 7 week high at $1.3722 this week, was a shade softer at $1.3624 in early trading on Friday.

Against the Yen, the EUR headed for its first gain in 3 days on speculation the European Central Bank (ECB) will take additional steps to keep down borrowing costs, possibly increasing demand for the currency. The EUR/JPY currency pair finished trading at 130.92 Yen from 129.42 Yen yesterday. Traders now wonder if the EUR can extend this 1 day gain against the JPY.

The market offered limited initial reaction to comments by members of the European Central Bank Governing Council, who on Thursday stated the ECB's key rate may eventually approach zero. Some analysts said recent comments from the ECB underlined disagreement between policymakers regarding how much lower Interest Rates can fall, and if this disagreement continues the result may be a bearish EUR in the medium-term.

The Pound Sterling remained under pressure after the Bank of England (BoE) said on Wednesday that it expected British inflation and the economy to recover more slowly than previously forecast. The Pound made impressive gains against the Dollar on Thursday to finish higher by over 100 pips at 1.5229. Today, investors have their eye on German Prelim GDP figures at 6.00 GMT, as this is likely to lead to volatility in the EUR/GBP cross.

Oil Goes Bullish on Weak Dollar

USD - Dollar Plummets on Jobless Claims Data

The U.S. Dollar plummeted considerably versus its major rivals on Thursday. This was amid uncertainty about the economic outlook, buoyed by modest safe-haven flows. The Dollar dived against the EU after a report showing U.S. jobless claims rose last week more than analysts originally forecasted. However, the U.S. and global stock markets made gains yesterday.

The USD fell by over 80 pips to 1.3634 against the EUR yesterday, after appreciating earlier to $1.3531, the strongest level since May 8. The Dollar also declined against the GBP by 110 pips to close at 1.5229. The U.S. currency, however, increased against the JPY to 95.99 Yen from a 95.47 opening. The Dollar has weakened in the past 3 weeks, falling to $1.3634 per EUR from $1.2886 on April 22, while the Standard & Poor's 500 Index reached its high for the year and Treasury yields rose amid an increase in risk appetite among investors.

The U.S. Dollar may appreciate further against the EUR after the 16-nation currency was unable to break above $1.3700 amid an increase in U.S. stocks. Stock markets remain a key driver of currencies, and their rise in yesterday's trading was clearly reflected in the bearishness of the Dollar, analysts said. Market players will be watching a heavy round of U.S. economic data on Friday, including April consumer price inflation, the University of Michigan consumer confidence survey.

Japanese Yen: Will Risk Flows Hold Up To A Severe Recession?

Fundamental Outlook for Japanese Yen: Neutral

- The vital, Japanese export sector is still weighing the economy down; but sentiment is still improving

- Despite the passing of so much significant event risk, sentiment has fallen back after months of rallying

- Is the USDJPY chart playing out a head and shoulders formation? The weekly technical outlook takes stock

The Japanese yen was one of the few currencies this past week to produce a consistent and aggressive move. Taking advantage of the unwinding of risky positions that were built up through most of March and April, the safe haven rallied 6.3 percent against the New Zealand dollar, 5.7 percent against the Australian currency and even managed a 3.3 percent advance against the greenback – the other safe haven currency. Looking ahead to next week, there will be two key, fundamental concerns for traders: the overall appetite for risk and the yen’s unwavering brand as the market’s harbor in uncertain seas.

The easier task is gauging the health of risk appetite. This past week, it was clear that optimism stalled. Without the threat of a major bank failure or shock to the credit market since the October market crash that followed the Lehman and AIG troubles, we have seen investors cautiously diversify away from risk-free assets like treasuries back into the more speculative asset classes like corporate bonds and equities. It is hard to miss the aggressive advance in key gauges like the Dow Jones Industrial Average and the DailyFX Carry Index . However, it is important to distinguish whether this is a rise in optimism or merely a return of investable funds to the market. In all likelihood, the bulk of this rebound can likely be attributed to capital finding its way back into the market in search of a competitive return. Investors wouldn’t attempt this if they were panicked; but if they believed the worst of the shocks are behind us, they would. However, this is different from a true rise in confidence where market participants have a major of their funds in the speculative arena and are trying to outpace the markets returns. With little hope for meaningful earnings, dividends, yields or capital returns through the rest of this year, traders will be standing with one foot out the door. All it will take is a possible financial crisis in the Euro Zone, US, UK, China or Japan and the whole world would reel in response.

While it is easy to determine the general level of sentiment in the market; it is a subtle and nuanced effort to measure an instrument’s relation to such a broad theme. Despite the significant deterioration in the Japanese economy over the past months, the yen has managed to retain its place as top refuge with few corrections. However, with each problem that arises from the Land of the Rising Sun (political, financial, economic), the less suited it seems for such a title. Indeed, we have to remember that this economy stagnated for more than a decade before this crisis as ill-conceived policy measures dampened a true recovery for the world’s second largest economy. Event risk over the coming days may feed such misgivings. Topping the list, is the preliminary revisions for the first quarter GDP readings. The initial 12.1 percent pace of contraction reported last month marked the worst slump since 1974. Should the plunge be revised down to 15.9 percent it would be the worst pace on record and likely signal a technical depression. Can an economy that is leading an economic malaise and will likely struggle to recover for years stand as a safe haven for capital? That is for the market to decide.

British Pound May Lose Ground Amidst Release of UK CPI, BOE Minutes

Fundamental Outlook for British Pound: Bearish

- UK trade deficit, jobless claims show signs of improvement

- UK industrial, manufacturing output declines start to slow

- Bank of England Quarterly Inflation Report triggers steep GBP losses amidst worsening outlook

The British pound wrapped up the past week down against the US dollar and Japanese yen, but up versus the rest of the majors. Looking to GBP/USD specifically, the pair remained contained within the same rising channel it has traded within for nearly a month, despite the bleak fundamental outlook for the UK. That said, there will be a variety of triggers for a GBP/USD breakdown next week, as inflation data and central bank-related news tends to spur volatility.

On Tuesday, the UK’s consumer price index (CPI) reading for the month of April is expected to rise 0.4 percent, the third straight increase. However, the annual rate of growth, which is more closely watched by the Bank of England, is forecasted to fall to a more than one-year low of 2.4 percent from 2.9 percent, keeping inflation within the central bank’s acceptable range of 1 percent - 3 percent, but above their 2 percent target. If CPI falls more than projected, the British pound could pull back sharply as the markets will anticipate that the BOE will expand their quantitative easing efforts even further. On the other hand, if CPI holds strong, the currency could rally in response.

On Wednesday, the minutes from the Bank of England's May 7 meeting may not be as market-moving as they've been in the past, as there has already been significant detail revealed about the mindset of the Monetary Policy Committee (MPC). Indeed, we already know that the BOE has decided to expand their quantitative easing program by 50 billion pounds to 125 billion pounds, that the drop in Q1 GDP of -1.9 percent was worse than expected, and that CPI will likely will be below the BOE’s 2 percent inflation target in the medium term. However, the growth and inflation outlook published in the BOE’s Quarterly Inflation Report suggests that the central bank may be open to expanding their quantitative easing program later on. If the minutes from the BOE’s most recent meeting reiterate this, the British pound could pull back very sharply.

Forex Trading Weekly Forecast - 05.18.09

Fundamental Outlook for US Dollar: Bullish

- Market participants see the eventual recovery in the global economy; but where is the US on this timeline?

- How prominent is the dollar’s safe haven status as risk appetite wavers?

- Find out what technicals project for the majors next week

Following up on a period of fundamental abundance with dramatic market events (the Fed Stress Test) and high-level economic indicators (non-farm payrolls), the dollar was put through its staid phase this past week. A round of indicators that included the April retail sales and May University of Michigan consumer confidence survey have put the focus back on the supposed ‘green shoots’ that so many policy officials and market commentators have noted recently. This will be the primary concern for dollar traders next week: is the United States leading the gradual economic recovery? However, this broad and speculative fundamental driver will only be able to guide price action if it is not interrupted by a more immediate concern – like a sharp rise or plunge in risk appetite.

Working with the forecast that there will be no unforeseen event that sweeps over the market and stirs sentiment, we will have a series of indicators and meetings that could guide the measured race for establishing the leader of the global economic recovery. As it stands, most of the major, industrial powerhouses are mired in recession; and the immediate outlook is far from promising. However, the currency market is a relative one and speculators are willing to look well into the future to discount the macro trends. So far, the US has shown signs that the pace of deterioration in employment, factory activity, consumer spending, confidence and the housing market are slowing. It should be noted that these trends are not positive, just less aggressive in their decline. And, these cautious ‘improvements’ have put the market at large on watch for ‘green shoots.’ We will see whether the Fed sees the same signs of hope with the minutes from the Federal Open Market Committee’s (FOMC) last policy meeting over April 28-29th. In previously released statements, the group has maintained its forecast for a contraction through the rest of the year and a slow recovery through the first half of 2010. If perhaps the central bankers are more encouraged by recent data, and they project perhaps a recovery sometime before the turn of the year, it would be a big vote for the US outpacing Japan, the UK and perhaps even the Euro Zone.

As for economic indicators, there are no key releases that promise heavy volatility; but there are those that will have their hand in guiding general growth forecasts. The Leading Indicators composite is typically overlooked; but the components of this indicator are exactly what is needed for projecting a true recovery. If there is any theme that can be derived from the docket, it will be the health of the housing market. The NAHB Housing Market Index for May and housing starts and permits data for April will cross the wires Monday and Tuesday. The sector indicator is expected to push an 8-month high (still far from positive territory) and the construction activity gauge is seen ticking higher (through from record lows). This was the area of the economy that triggered the recession. Can it be the source of the recovery?

And, though the market has shifted its attention to the economy; there is no doubt that sentiment will continue to hold the potential influence over the dollar. The greenback is still considered a top safe haven in FX circles; but that can shift should US-specific risks arise. This means we need to not only watch the general level of sentiment in the market but the various currencies’ connection to risk as well. One concern that could easily blow up under the right conditions is the health of the financial system. The Fed’s Stress Test seemed to offer an honest assessment of the state of the country’s largest banks. However, there are many critics that think that floating losses were understated to help pad sentiment until a real recovery can form. If that is the case, an unforeseen shock can send the market’s into another crisis. We will monitor Treasury Secretary Geithner’s testimony on TARP for reasons cracks in the cautious optimism.

Saturday, May 16, 2009

jPY - The Yen Declines vs. the USD as Stocks Rebound

The Yen fell against the EUR for the first time in 4 days as a gain in stocks encouraged investors to buy higher-yielding assets funded with Japan's currency.

The JPY declined by over 1% against the EUR to 130.92 from 129.42 yesterday .The Yen also weakened earlier 1% against the Dollar to 95.99, because of selling to protect options that would become worthless should Japan's currency rise further, according to analysts.

The Yen may reverse this year's decline against the Dollar as Japan's currency succeeds the greenback as the best refuge from the financial crisis. The Japanese currency may appreciate to 92 yen by the end of the year as the link between the greenback and risk aversion deteriorates. As for today, forex traders are advised to follow the U.S. Core CPI data release at 12.30 GMT, as the results of this are highly likely to determine USD/JPY trading going into next week.

Crude Oil - Crude Rises Above $59 a Barrel

Crude Oil prices rose on Thursday, tracking a rebound on Wall Street, though a gloomy demand forecast from the International Energy Agency (IEA) limited gains.

Crude prices rose $2, or 4%, to settle at $59.53 a barrel. Oil prices continue to track equities markets as traders look to stocks for signs of an economic recovery that could lift ailing world fuel demand. The other factor that helped Oil prices yesterday was the weak Dollar, directly leading to a bullish price of Oil.

The 11 members of the Organization of Petroleum Exporting Countries (OPEC) bound by production targets implemented 77% of planned cuts of 4.2 million barrels a day in April, down from a revised 82% for March. The cartel next meets on May 28, and is unlikely to alter production limits if prices remain strong, Iraq's oil minister said Thursday. The price of Crude may hit $65 by the end of the month if additional solid signs of an earlier-than-forecasted economic recovery become more apparent.

EUR - The Euro-Zone Goes Defensive on ECB Policy Concerns

Against the Yen, the EUR headed for its first gain in 3 days on speculation the European Central Bank (ECB) will take additional steps to keep down borrowing costs, possibly increasing demand for the currency. The EUR/JPY currency pair finished trading at 130.92 Yen from 129.42 Yen yesterday. Traders now wonder if the EUR can extend this 1 day gain against the JPY.

The market offered limited initial reaction to comments by members of the European Central Bank Governing Council, who on Thursday stated the ECB's key rate may eventually approach zero. Some analysts said recent comments from the ECB underlined disagreement between policymakers regarding how much lower Interest Rates can fall, and if this disagreement continues the result may be a bearish EUR in the medium-term.

The Pound Sterling remained under pressure after the Bank of England (BoE) said on Wednesday that it expected British inflation and the economy to recover more slowly than previously forecast. The Pound made impressive gains against the Dollar on Thursday to finish higher by over 100 pips at 1.5229. Today, investors have their eye on German Prelim GDP figures at 6.00 GMT, as this is likely to lead to volatility in the EUR/GBP cross.

Oil Goes Bullish on Weak Dollar

USD - Dollar Plummets on Jobless Claims Data

The U.S. Dollar plummeted considerably versus its major rivals on Thursday. This was amid uncertainty about the economic outlook, buoyed by modest safe-haven flows. The Dollar dived against the EU after a report showing U.S. jobless claims rose last week more than analysts originally forecasted. However, the U.S. and global stock markets made gains yesterday.